The US fresh and raw dog food market is expanding rapidly as owners look for healthier, human-grade alternatives to mass-market diets. This growth has made organic search one of the key routes for brand discovery and competitive differentiation.

At Bubblegum Search, we analysed the organic performance of 20 leading US fresh and raw dog food brands to identify which brands lead the market and what drives their visibility.

Executive Summary

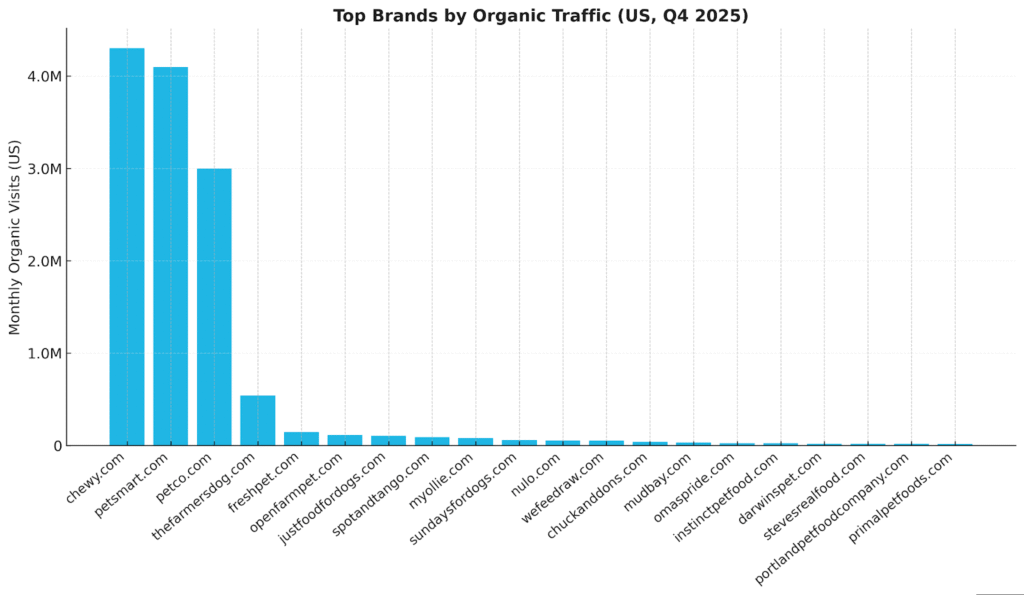

- Traffic leaders: Chewy, PetSmart and Petco dominate US organic visibility, each attracting multi-million monthly visits. Within the fresh and raw category, The Farmer’s Dog leads decisively, followed by JustFoodForDogs, Freshpet, Spot and Tango, and My Ollie.

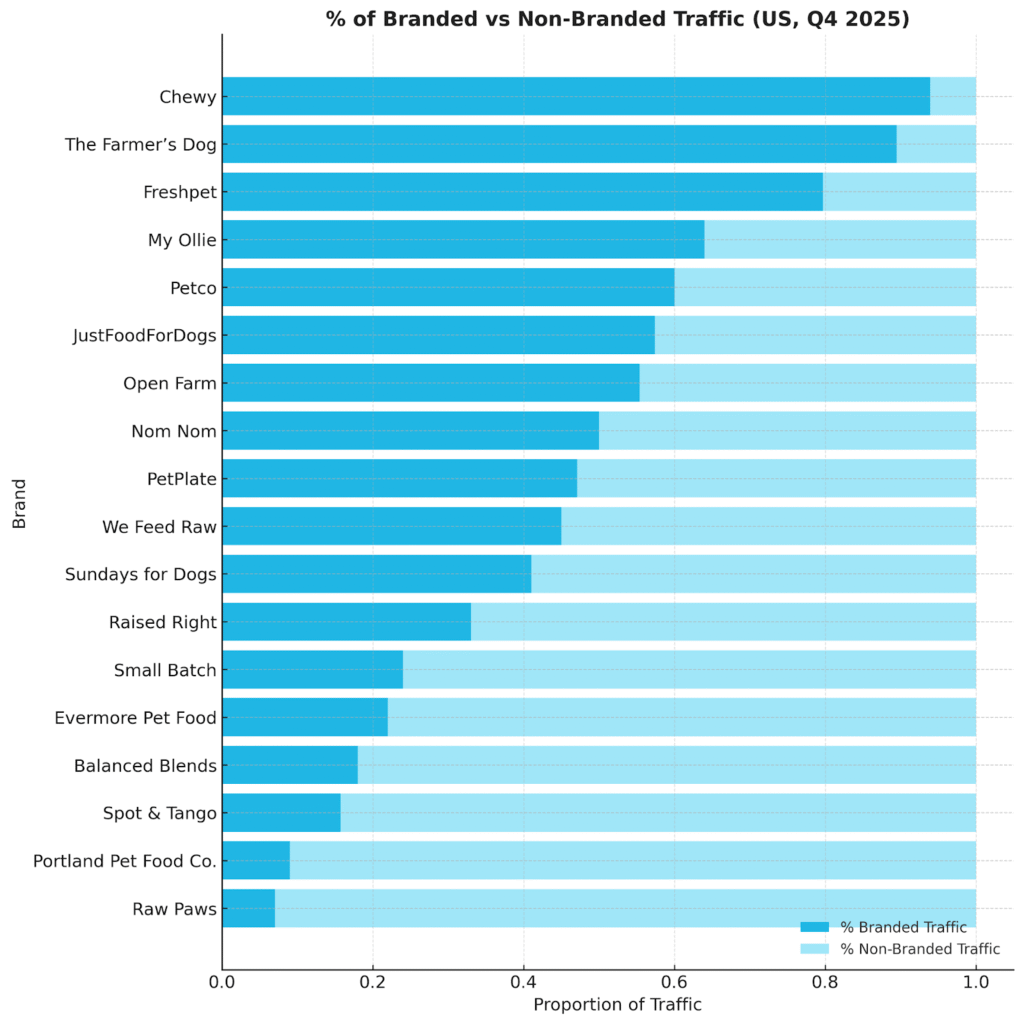

- Brand vs generic: The US market leans strongly toward branded search. Chewy, The Farmer’s Dog and Freshpet rely heavily on existing brand demand, while challenger brands such as Spot and Tango, PetPlate and Portland Pet Food Co. attract more discovery-led visibility.

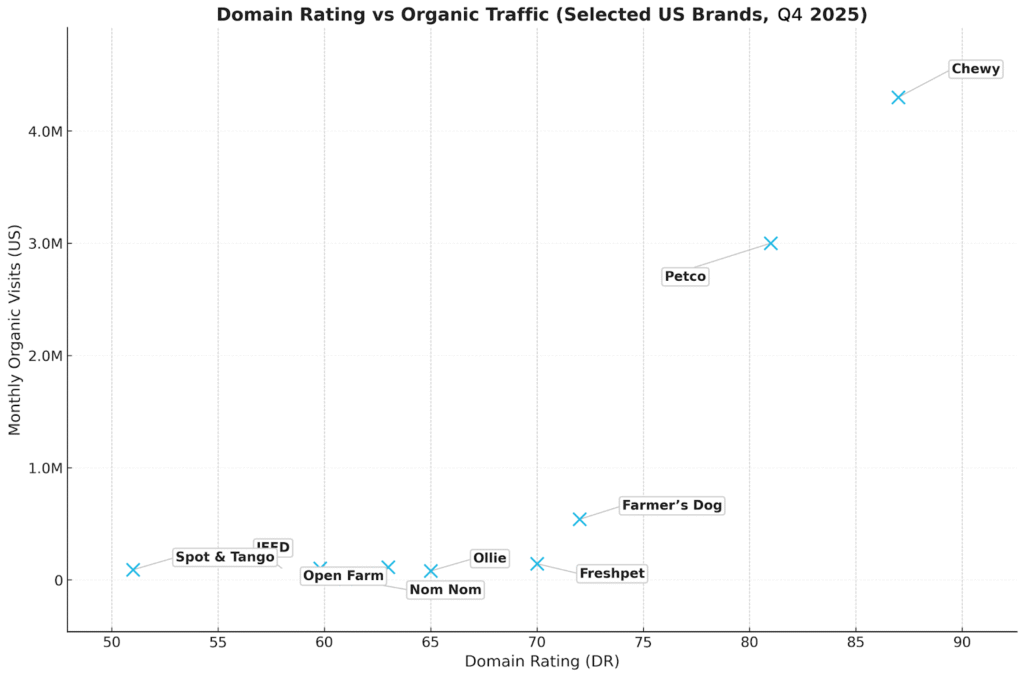

- Authority vs traffic: High DR correlates only moderately with organic reach. Chewy and Petco top the authority charts, yet mid-tier brands like JustFoodForDogs and Spot and Tango outperform stronger domains through broader informational content and intent coverage.

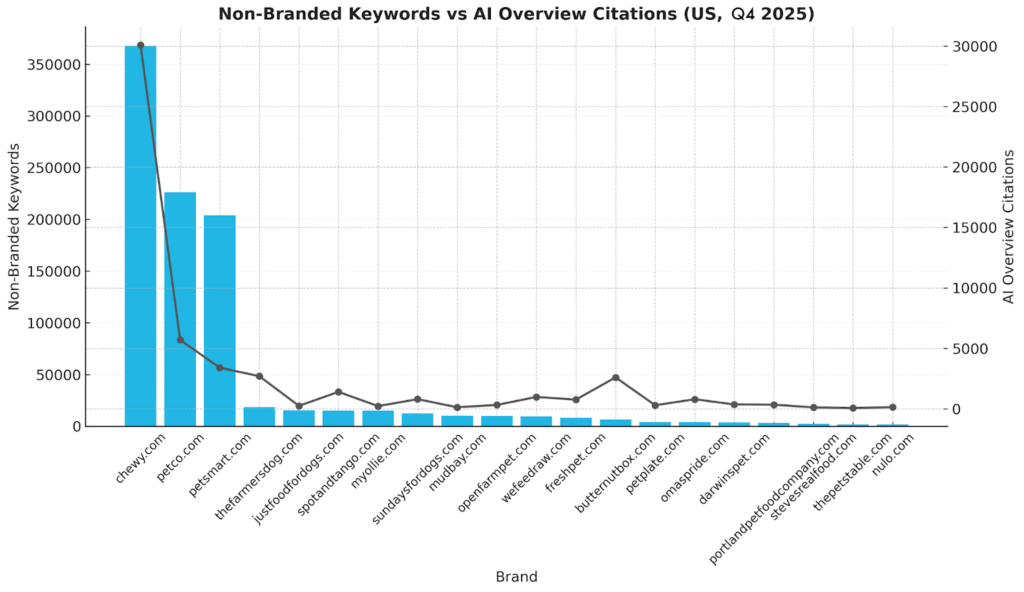

- AI Overviews: AI-generated results amplify brand dominance. Chewy leads with more than 30,000 citations, followed by Petco and PetSmart. Among specialist brands, The Farmer’s Dog and Spot and Tango outperform peers, while many smaller competitors have minimal AI visibility.

Strategic Takeaway:

The brands winning US organic visibility balance brand-led demand with broad informational discovery, authoritative backlinks, and AI-ready structures. Laggards rely too narrowly on brand recognition or maintain thin content ecosystems, limiting both ranking and AI-era exposure.

Methodology

- Scope: 20 US fresh and raw dog food brands, including direct-to-consumer meal providers, hybrid manufacturers and national retailers.

- Data sources: Ahrefs (Q4 2025 snapshot), proprietary organic traffic analysis and AI Overview monitoring.

- Metrics analysed:

- Organic traffic (US)

- Ranking keyword footprint

- Branded vs non-branded traffic split

- Domain Rating (DR) and referring domains

- Leading branded and generic keywords

- AI Overview citations across category terms

Key Findings

Organic Traffic Leaders in the US Market

| Rank | Brand | Monthly Visits (US) | DR | Ranking Keywords |

| 1 | Chewy | 4,300,000 | 87 | 371,000+ |

| 2 | PetSmart | 4,100,000 | 80 | 221,000+ |

| 3 | Petco | 3,000,000 | 81 | 235,000+ |

| 4 | The Farmer’s Dog | 539,600 | 72 | 19,700 |

| 5 | JustFoodForDogs | 104,100 | 58 | 15,652 |

| 6 | Freshpet | 144,300 | 70 | 9,024 |

| 7 | Spot & Tango | 90,000 | 51 | 15,265 |

| 8 | My Ollie | 79,200 | 65 | 15,425 |

| 9 | Open Farm | 113,400 | 63 | 10,279 |

| 10 | PetPlate | 8,500 | 58 | 4,061 |

Observation:

- Chewy, PetSmart and Petco dominate total US pet-related search with 4.3M, 4.1M and 3.0M monthly visits respectively, setting a scale that shapes category-wide visibility.

- Within the specialist fresh and raw segment, The Farmer’s Dog leads with more than half a million monthly visits, outperforming all mid-tier and challenger brands combined.

- JustFoodForDogs, Freshpet, Spot and Tango, and My Ollie form the next tier, gaining visibility through strong branded demand and expanding educational content rundowns.

- The steep traffic drop-off beyond the top tier highlights a highly concentrated US search environment, far more compressed than the UK landscape.

Branded vs Non-Branded Visibility in the US

| Brand | % Branded Traffic | % Non-Branded Traffic | Monthly Organic Visits (US) |

| Chewy | 93.9 % | 6.1 % | 4,300,000 |

| The Farmer’s Dog | 89.5 % | 10.5 % | 540,000 |

| Freshpet | 79.7 % | 20.3 % | 144,000 |

| PetSmart | 69.9 % | 30.1.3 % | 4,100,000 |

| My Ollie | 64.0 % | 36.0 % | 79,000 |

| Petco | 60.0 % | 40.0 % | 3,000,000 |

| JustFoodForDogs | 57.4 % | 42.6 % | 104,000 |

| Open Farm | 55.4 % | 44.6 % | 113,000 |

| PetPlate | 47.1 % | 52.9 % | 8,500 |

| We Feed Raw | 45.0 % | 55.0 % | 17,000 |

| Nom Nom | 50.0 % | 50.0 % | 62,000 |

| Sundays for Dogs | 41.0 % | 59.0 % | 21,000 |

| Raised Right | 33.0 % | 67.0 % | 9,000 |

| Small Batch | 24.0 % | 76.0 % | 4,000 |

| Evermore Pet Food | 22.0 % | 78.0 % | 3,000 |

| Balanced Blends | 18.0 % | 82.0 % | 2,000 |

| Spot & Tango | 15.7 % | 84.3 % | 90,000 |

| Portland Pet Food Co. | 9.0 % | 91.0 % | 6,000 |

| Raw Paws | 7.0 % | 93.0 % | 5,000 |

Observation:

- Chewy and The Farmer’s Dog rely heavily on branded searches, with branded shares above 90 percent and 89 percent respectively, signalling deep awareness but limited generic reach.

- Mid-tier brands including Freshpet, My Ollie and Nom Nom also skew brand-led, benefiting from strong loyalty but relying less on discovery keywords.

- Discovery-driven challengers such as Spot and Tango, PetPlate, Portland Pet Food Co. and We Feed Raw attract a higher proportion of non-branded searches through informational nutrition and feeding content.

- Balanced brands such as JustFoodForDogs and Open Farm achieve dual visibility, helping them reach both loyal customers and early-stage searchers.

Domain & Backlink Authority Across US Brands

| Brand | Domain Rating (DR) | Referring Domains | Monthly Organic Visits (US) |

| Chewy | 87 | 42,400 | 4,300,000 |

| Petco | 81 | 31,500 | 3,000,000 |

| The Farmer’s Dog | 72 | 6,500 | 539,600 |

| Freshpet | 70 | 2,800 | 144,300 |

| Open Farm | 63 | 2,800 | 113,400 |

| JustFoodForDogs | 58 | 4,300 | 104,100 |

| Spot & Tango | 51 | 2,700 | 90,000 |

| My Ollie | 65 | 4,400 | 79,200 |

| Nom Nom | 61 | 2,300 | 9,700 |

| PetPlate | 58 | 3,500 | 8,500 |

Observation:

- Chewy (DR 87) and Petco (DR 81) maintain the strongest authority footprints, reflecting extensive link profiles built across retail, editorial and informational ecosystems.

- Freshpet and Open Farm hold mid-tier authority positions, yet specialists like JustFoodForDogs and Spot and Tango often outperform them through stronger topic coverage and feeding guidance.

- Authority alone does not determine reach. The Farmer’s Dog achieves higher traffic than many stronger domains thanks to broad keyword coverage, owner education content and strong engagement metrics.

- Smaller brands with low DR must rely on consistent digital PR and link earning to remain competitive in an authority-weighted landscape.

AI Overview Presence in US Search

| Brand | AI Citations (Q4 2025) |

| Chewy | 30,100 |

| Petco | 5,700 |

| PetSmart | 3,400 |

| The Farmer’s Dog | 2,700 |

| Spot & Tango | 1,400 |

| Freshpet | 760 |

| Open Farm | 319 |

| PetPlate | 294 |

| My Ollie | 223 |

| Nom Nom | 115 |

| JustFoodForDogs | 244 |

Observation:

- Chewy leads AI citation volume with more than 30,000 appearances in AI-generated answers, reflecting deep domain trust and extensive brand mentions across the web.

- Petco and PetSmart follow with thousands of citations, benefitting from large content ecosystems and strong external authority signals.

- Among specialist fresh and raw brands, The Farmer’s Dog and Spot and Tango demonstrate the strongest AI presence, driven by structured FAQs, feeding guides and broad informational coverage.

- Smaller brands with minimal AI visibility risk losing mid-funnel discovery as AI-generated answers become a dominant part of US search behaviour.

Correlation Analysis: What Separates US Leaders from Laggards

| Metric | Leaders (Top 3) | Laggards (Bottom 3) | Correlation |

| Average Monthly Visits | 2.6M | 9.3k | – |

| Average DR | 80 | 59 | 0.57 |

| Average Referring Domains | 26,000 | 2,900 | Strong |

| Branded Share | 81% | 47% | Moderate |

| AI Citations | 12,166 | 241 | High |

| Keyword Breadth | 208k | 3,300 | Very Strong |

- Leaders such as Chewy, PetSmart, Petco and The Farmer’s Dog combine broad keyword footprints, high branded demand, strong domain authority and significant AI Overview visibility.

- Mid-tier players such as Freshpet, JustFoodForDogs, My Ollie and Open Farm maintain strong DRs but vary significantly in keyword breadth, influencing their traffic performance.

- Challenger brands like Spot and Tango, PetPlate and Portland Pet Food Co. compete effectively through discovery-led visibility, outperforming brands with higher DR but narrower content.

- Laggards typically have limited keyword coverage, lower link velocity and little or no AI citation presence, restricting both ranking and AI-driven exposure.

Implications

- The US market is heavily consolidated, with major retailers controlling overall search volume while specialist brands compete for a narrower but high-intent slice of queries.

- High branded dependence signals loyalty but limits reach among new pet owners researching feeding questions and comparing fresh/raw options.

- AI-driven search introduces a new layer of competition where structured, authoritative content determines visibility inside answer panels.

- Brands that fail to build strong link ecosystems and owner-focused educational content risk losing mid-funnel discovery opportunities.

- Content hubs centred on nutrition, feeding guidance and pet health have become key differentiators for category growth.

Recommendations

- Expand informational content across nutrition, feeding, health and dog-owner education to build non-branded visibility.

- Implement structured data, FAQs and schema to increase AI Overview inclusion and strengthen authority signals.

- Invest in digital PR targeting pet, health, lifestyle and news media to diversify referring domains and increase brand trust.

- Track branded search demand as a measure of loyalty and offline influence to balance brand-led and discovery-led strategies.

- Refresh evergreen feeding, nutrition and health guides regularly to maintain topical authority and search relevance.

- Integrate SEO, content and PR into a unified authority-building engine to compete across traditional and AI-driven search.

Conclusion

The 2025 US fresh and raw dog food search landscape reflects a tight divide between high-authority brands with extensive keyword coverage and those with narrow visibility footprints. Chewy, Petco, PetSmart and The Farmer’s Dog lead through brand equity, topic breadth and AI-era authority.

Mid-tier brands such as Freshpet, JustFoodForDogs, My Ollie and Spot and Tango demonstrate strong category influence but must continue to expand informational coverage to compete with dominant players in AI-driven search.

Brands relying solely on brand awareness or thin content strategies risk stagnation as AI reshapes how pet owners discover and compare feeding options. Those investing in educational ecosystems, structured content and authority-building stand to gain the greatest visibility advantage in 2026.

Want To Outrank The Competition?

We will show you:

- Why competitors are ahead in organic search

- Where your biggest opportunities lie

- How to close the authority gap with an integrated SEO and PR strategy

👉 Learn more about our integrated SEO + PR packages.