The UK’s Fresh & Raw dog food market continues to grow rapidly, driven by owners seeking healthier, high-quality alternatives to traditional kibble. This expanding demand has made search visibility one of the most competitive battlegrounds in the pet industry.

At Bubblegum Search, we analysed the organic performance of 20 leading Fresh & Raw dog food brands to uncover who’s winning – and why.

Executive Summary

- Traffic Leaders: Butternut Box, Nature’s Menu, and Bella & Duke lead UK organic visibility in the Fresh & Raw category, each capturing significant search share across informational and branded terms.

- Brand vs. Generic: Raw Made Simple, Nutriment, and Raw Dog Food Company excel at discovery-led visibility, while Tuggs and Paleo Ridge lean heavily on branded traffic.

- Authority vs. Traffic: High authority doesn’t guarantee reach – Freshpet’s DR rivals top players, yet its organic footprint lags behind.

- AI Overviews: Butternut Box and Bella & Duke dominate AI Overview citations, showing how structured, answer-driven content pays off.

Strategic Takeaway: The Fresh & Raw leaders balance authority, topic breadth, and discoverability – optimising for both human readers and Google’s evolving AI landscape.The findings reveal clear differences in strategy, with some brands owning category-wide discovery while others rely too heavily on brand awareness.

Methodology

- Scope: 20 Fresh & Raw dog food brands operating in the UK direct-to-consumer market.

- Data sources: Ahrefs (Q3 2025 snapshot), Bubblegum Search’s AI Overview monitoring, and proprietary organic traffic analysis.

- Metrics analysed:

- Organic traffic (UK)

- Ranking keywords

- Branded vs. non-branded share

- Domain Rating (DR) and referring domains

- AI Overview citations

- Organic traffic (UK)

Key Findings

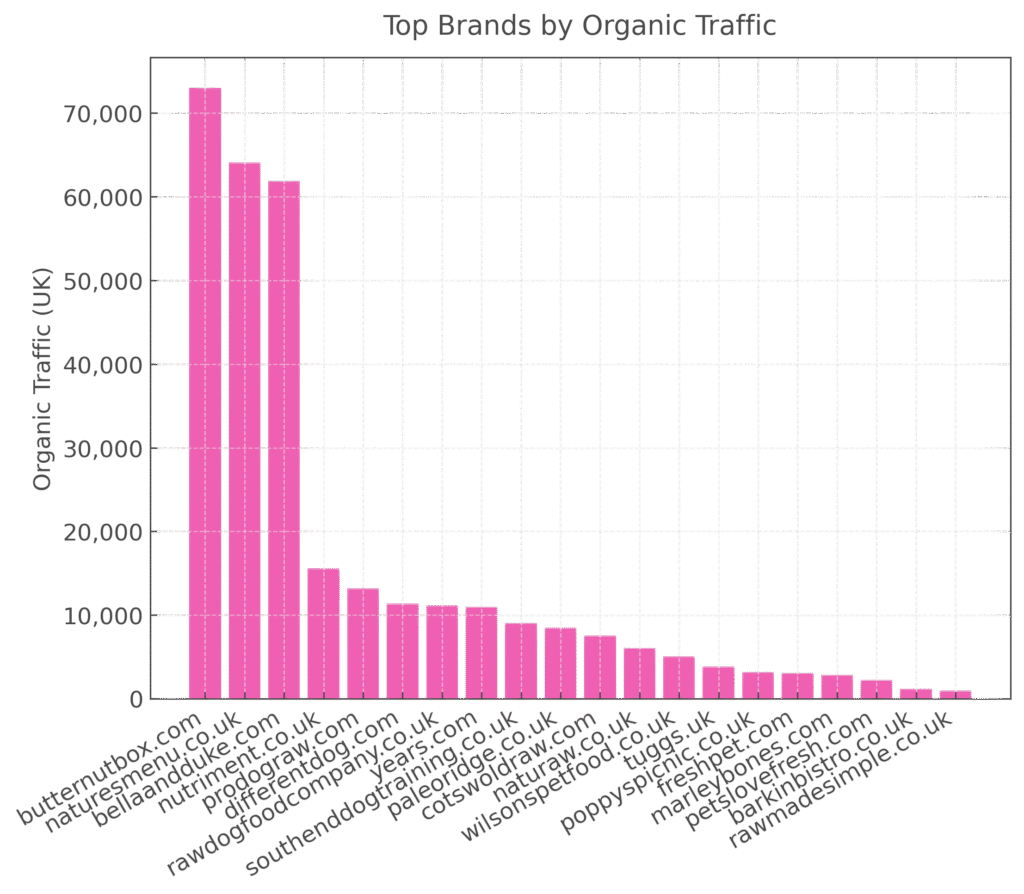

Organic Traffic Leaders

| Rank | Brand | Monthly Visits (UK) | DR | Keywords Ranked |

| 1 | Butternut Box | 73,000 | 67 | 16,700+ |

| 2 | Nature’s Menu | 64,100 | 56 | 10,200+ |

| 3 | Bella & Duke | 61,900 | 54 | 19,000+ |

| 4 | Nutriment | 15,600 | 55 | 6,400+ |

| 5 | ProDog Raw | 13,200 | 51 | 5,900+ |

| 6 | Paleo Ridge | 9,800 | 61 | 4,500+ |

Observation:

- Butternut Box dominates both visibility and authority, combining brand demand with expansive content coverage.

- Bella & Duke’s strong keyword footprint shows the power of education-focused content and expert-led advice.

- Mid-tier brands like Nutriment are growing quickly by targeting informational intent rather than product-only queries.

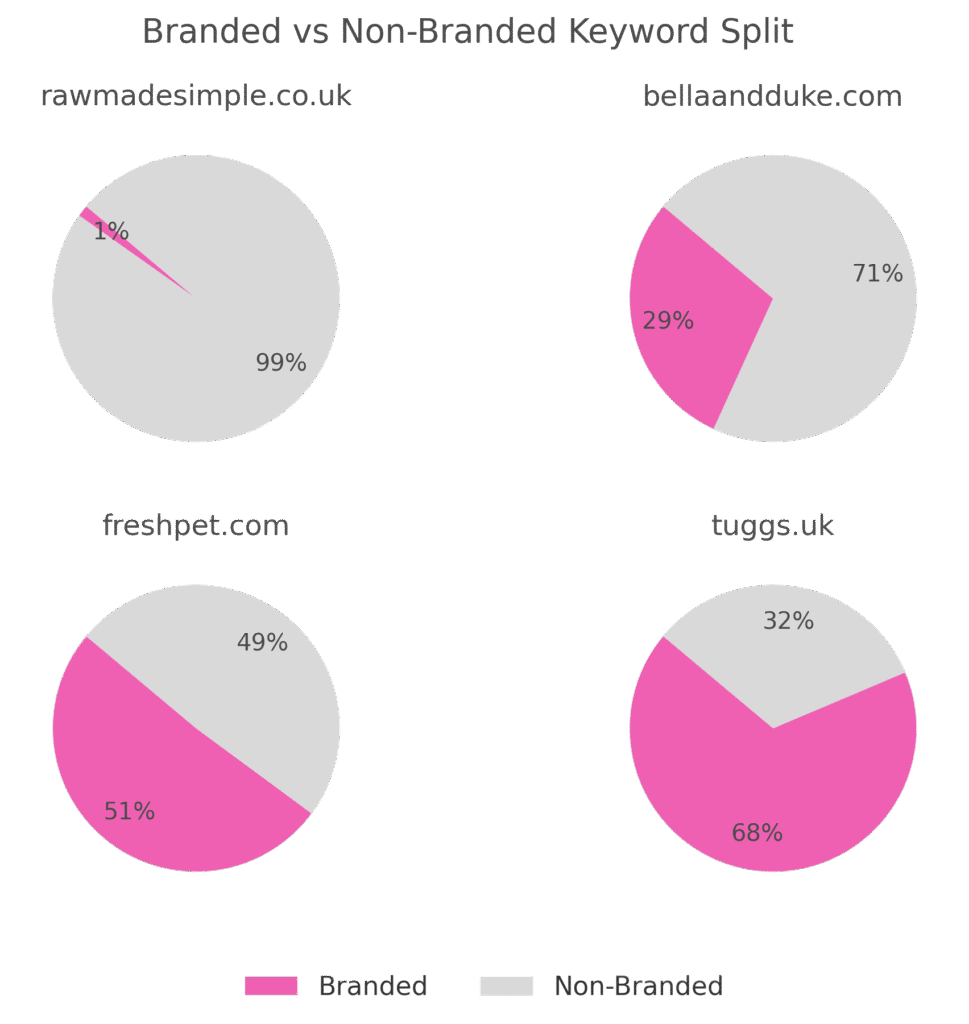

Branded vs. Non-Branded Visibility

| Brand | % of Branded Traffic | Positioning |

| Raw Made Simple | 1% | Discovery-led |

| Nutriment | 4% | Discovery-led |

| Raw Dog Food Company | 5% | Discovery-led |

| Butternut Box | 31% | Balanced |

| Bella & Duke | 41% | Balanced |

| Nature’s Menu | 38% | Balanced |

| Tuggs | 68% | Brand-led |

| Paleo Ridge | 65% | Brand-led |

| Marleybones | 56% | Brand-led |

Insight:

- Discovery-led brands attract owners early in the buying journey through how-to guides and feeding advice.

- Balanced brands, like Butternut Box and Bella & Duke, blend educational content with strong branded engagement.

- Brand-led players such as Tuggs and Paleo Ridge risk missing growth opportunities beyond loyal repeat customers.

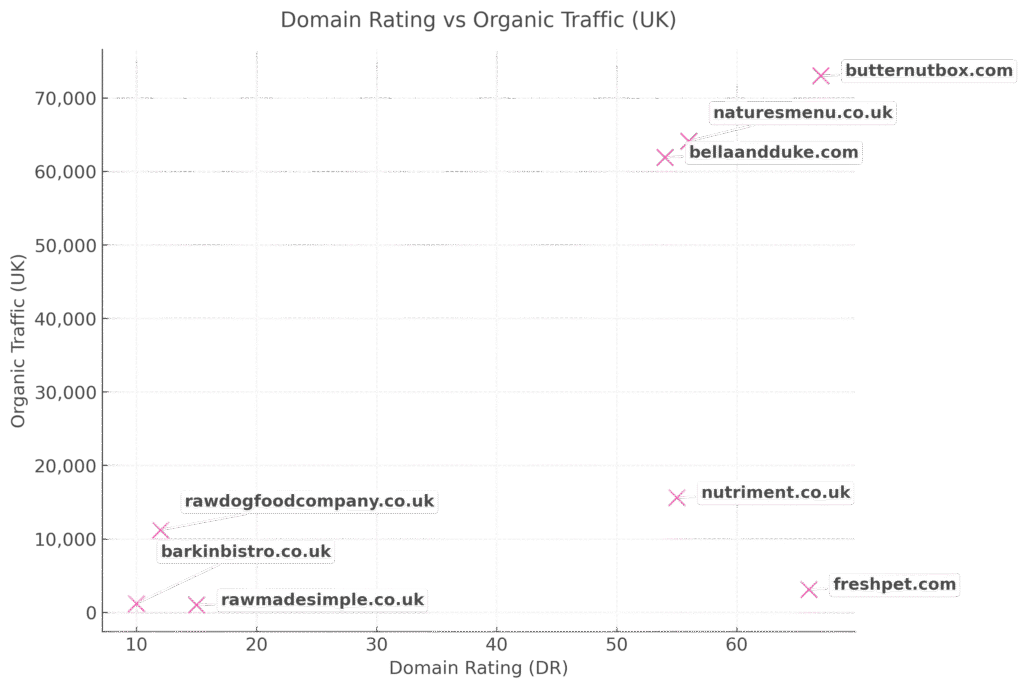

Domain/Backlink Authority

| Brand | DR | Referring Domains | Traffic (UK) |

| Butternut Box | 67 | 3,800+ | 73k |

| ProDog Raw | 51 | 3,600+ | 13k |

| Bella & Duke | 54 | 3,400+ | 62k |

| Freshpet | 66 | 2,700+ | 7k |

| Nutriment | 55 | 2,200+ | 16k |

Observation:

- High DR doesn’t always equal high visibility – Freshpet proves that backlinks alone can’t drive growth without topical depth.

- Butternut Box and Bella & Duke combine authority with consistent Digital PR, resulting in both brand recognition and discovery reach.

- ProDog Raw stands out as an emerging challenger, leveraging linkable feeding resources to climb authority charts.

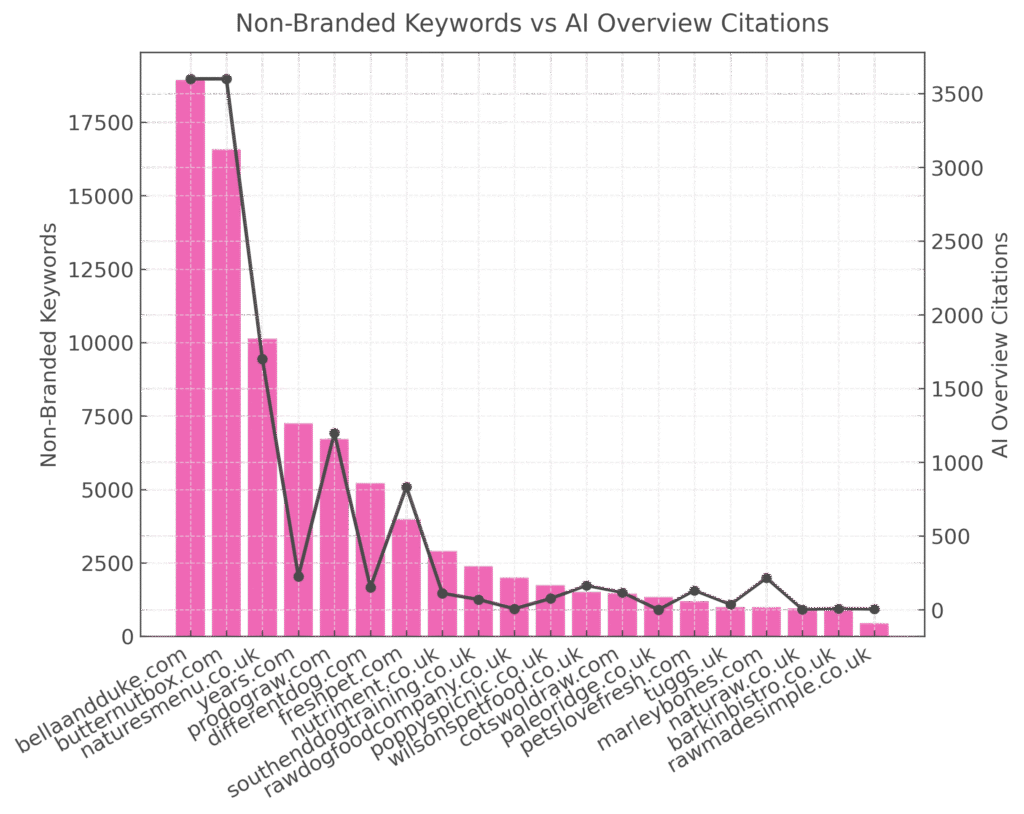

AI Overview Presence

| Brand | AI Overview Citations |

| Butternut Box | 3,600 |

| Bella & Duke | 2,800 |

| Nature’s Menu | 1,700 |

| ProDog Raw | 1,200 |

| Freshpet | 834 |

Takeaway:

- Butternut Box leads AI citations thanks to structured content and natural-language optimisation.

- Bella & Duke continues to be recognised in AI-generated results for nutrition and feeding topics.

- Brands that earn external mentions (news sites, forums, vet sites) are more likely to appear in AI Overviews, signalling trust.

Correlation Analysis: What Separates Leaders from Laggards

When comparing the top three brands (Butternut Box, Nature’s Menu, Bella & Duke) with the bottom three of the top 20 overall brands (Raw Made Simple, Marleybones, Tuggs), clear differences appear across every key metric:

| Metric | Leaders (Top 3) | Laggards (Bottom 3) | Correlation |

| Keyword breadth | 10k–19k keywords | <2k keywords | Strongest traffic driver |

| Branded share of traffic | 30–40% (balanced) | 55–70% branded, or <10% (too niche) | Balance outperforms extremes |

| Domain Rating (DR) | 54–67 | 34–55 | Baseline requirement, not decisive |

| Referring domains | 3k–4k | <800 | More unique domains = wider reach |

| AI citations | 1.7k–3.6k | Negligible | Driven by off-site mentions + authority |

| Content depth | Multiple content hubs (feeding, health, breed-specific) | Reliant on homepage & product pages | More linkable assets = stronger overall SEO |

Correlation Summary:

- Leaders combine broad keyword coverage with balanced branded traffic and diversified link profiles.

- Laggards either over-rely on brand searches or fail to create enough informational content to earn links and mentions.

- The highest-growth brands align SEO, PR, and content around one strategy – topic authority.

Implications

- Fresh & Raw search visibility is consolidating – a few brands dominate because they serve both informational and transactional intent.

- Authority alone no longer differentiates; consistent off-site mentions now define trust signals.

- AI search is rewriting discovery: appearing in AI Overviews is emerging as the new top-of-funnel advantage.

- Content depth is the common factor – structured, updated, and owner-focused pages drive every major performance metric.

Recommendations

- Balance branded and non-branded strategy. Serve loyal customers and attract first-time searchers simultaneously.

- Invest in AI-friendly content. Build FAQs and guides that answer direct owner questions with structured markup.

- Leverage Digital PR. Earn authoritative mentions from pet blogs, news outlets, and vet resources.

- Track branded search growth. Use it as an indicator of marketing impact and content resonance.

- Refresh evergreen content. Keep feeding, storage, and comparison guides current to sustain visibility.

- Integrate SEO and PR. Treat them as one connected growth engine – not siloed activities.

Conclusion

The Fresh & Raw dog food category shows that organic search success isn’t about size – it’s about strategy.

Leaders like Butternut Box, Bella & Duke, and Nature’s Menu win because they combine educational content, consistent PR coverage, and strong technical optimisation.

Brands that evolve their strategy toward structured discovery and off-site authority building will secure long-term visibility as AI search continues to expand.

Ready to outrank the pack?

Get your free Authority Gap Audit.

We’ll show you:

- Why competitors are ahead

- Which content and authority gaps to close

- How to future-proof your visibility with SEO + Digital PR